Insurance costs have risen slightly over 2020, and this is being seen primarily in premiums for families and high-income workers. However, overall medical costs have gone down somewhat.

According to a recent article at U.S. News & World Report, health care costs were down in 2020, as many people chose to forgo elective surgeries, regular screenings, and routine doctors’ visits, and stayed home during the coronavirus pandemic. But insurers and employers are concerned about what may happen to costs in 2021, when people finally get the delayed screenings and deferred care.

The article goes on to quote Ellen Kelsay, president and CEO of the Business Group on Health,

“People are starting to resume some of those services that were deferred, whether it’s going to their annual preventive care visit or annual cancer screening.”

However, many people do not make the most of their coverage most of the time – with or without a pandemic.

More Virtual “Face Time” With Care Providers

One of the most effective ways to take advantage of the changes and shifts in medical care is to make more use of virtual care.

This approach was originally approached as a low-cost alternative to costly emergency room or urgent care center visits. This was especially useful for common complaints such as sinus and upper respiratory infections, allergies, flu, coughs, and rashes.

However, the use of virtual care options skyrocketed during the COVID-19 crisis and many physicians and care providers have been using telehealth channels to see more patients remotely more often. A majority of patients have been positive about their experience, as well as the convenience and cost savings of virtual care.

A study by the Business Group on Health found that 80 percent of employers believe virtual care will have a significant impact on how care is delivered in the future, while 53 percent of the large employers have made more virtual care solutions in 2021 their top initiative for the year.

2020 is Finally Over – But COVID-19 is Still Looming

Getting the most out of your health insurance involves more than simply getting the balancing lower premiums with lower deductibles and cost shares. What will your plan cover and how much?

With the specter of the current coronavirus still hovering, COVID testing and treatment is still a valid concern, especially for families and older people. When it comes to your insurance plan, knowing it will cover testing and treatment for COVID-19 is essential.

While testing is generally covered with most plans, if you need hospital care for COVID-19, you’ll likely have co-pays and deductibles. This means that, for those who are at high risk for contracting COVID-19 or for suffering severe complications from it, more extensive hospital coverage may be needed.

Take Advantage of Your Good Health Track Record

An HSA, or Health Savings Account, is an individual account designed to work together with an HSA-eligible high-deductible health plan (HDHP). Eligible contributions are tax-deductible, and you can use your HSA money tax-free to pay for qualified medical expenses for you, your spouse, and your qualified dependents.

In other words, HSAs let you put away pre-tax money indefinitely for medical needs. This can lower your tax bill at the end of the year, and if you never need to use those funds for medical expenses, they’re treated much like a traditional IRA.

Plus, your HSA is not “use-it-or-lose-it” because the account belongs to you, not an employer, so your contributions can accumulate year after year.

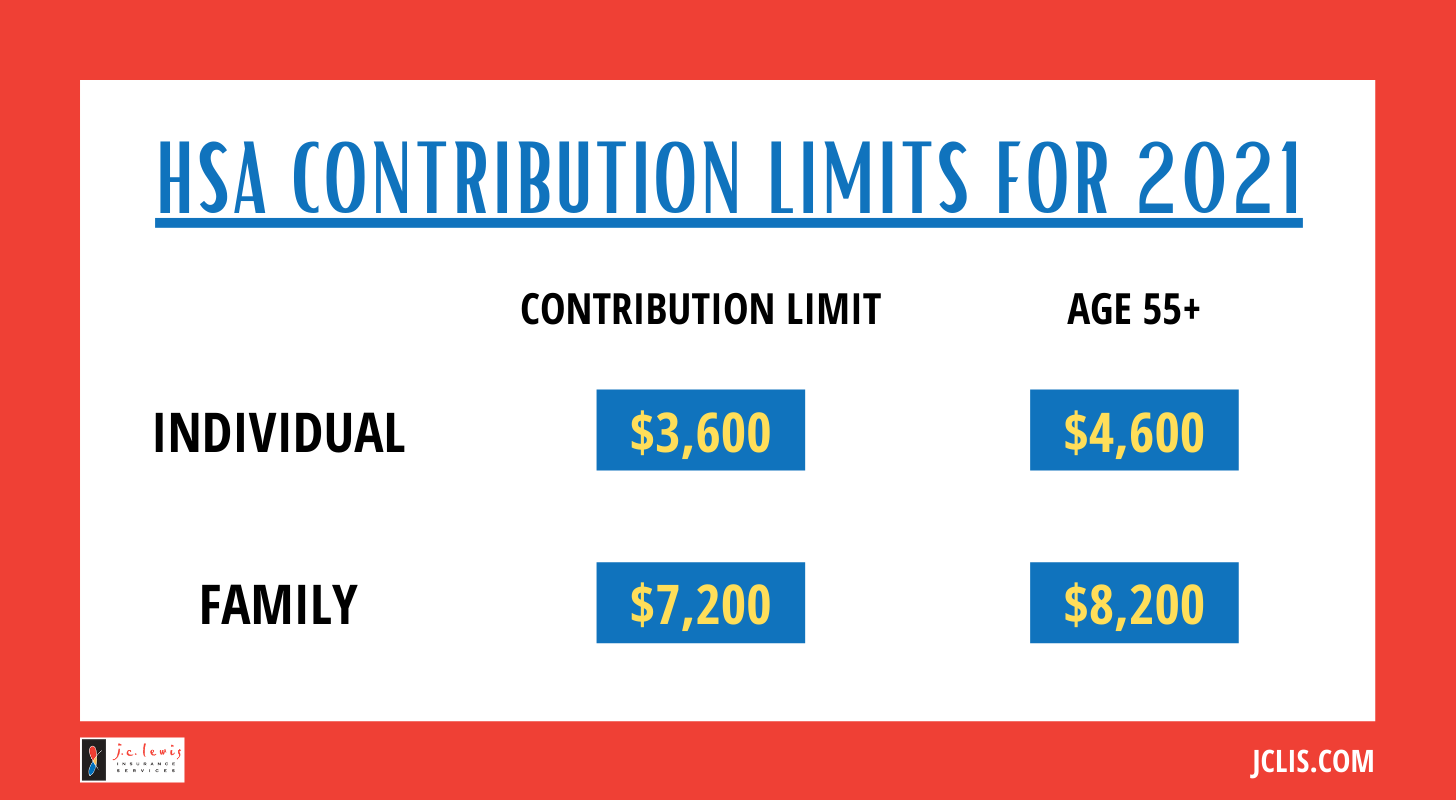

HSA contribution limits for 2021

And, according to a post at ValuePenguin.com,

“Those who turn 55 or older during 2021 can contribute an extra $1,000 to their HSA. If both spouses are over 55 years old, they can both make the $1,000 catch-up contribution, but since HSAs are filed under one person’s name, each spouse needs to open an individual account, rather than one family account, to contribute the maximum of $9,200. Since medical costs continue to rise and consume a large portion of retirees’ savings, anybody who is able to should consider maxing out their HSA.”

We’re Here to Help with Your Insurance Needs

Health insurance is essential and there is much more for you than simply covering some of your cost. Ultimately, the goal is to provide quality medical protection for you and your family.

The details and options of health insurance are quite a bit to sort through and evaluate. If you don’t feel comfortable doing it on your own, you can work with an agent, like J. C. Lewis, to help you navigate through your options and make your choice.

J.C. Lewis Insurance Services offers a variety of affordable and flexible options that allow individuals and business owners to choose health insurance coverage options suited to their specific needs.

At J.C. Lewis Insurance Services, we can tailor our recommendations to your particular needs since we are licensed with most major carriers in California. You save time and money, and we can quickly define your insurance needs and recommend the best products and prices to meet those needs.

We are a family-owned and operated California health insurance agent located in Sonoma County. We are licensed to do business in California, and we specialize in medical insurance plans for small businesses, as well as for individuals and families and people with Medicare.